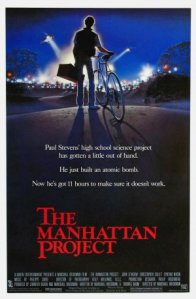

A couple of days ago, I found myself watching The Manhattan Project, a movie that is named after a real life program during World War II. To be honest, the movie is quite slow and revolves around this young physics student who wants to create a nuclear bomb for a national science fair. It is an extraordinary story but one that has been narrated and directed poorly, making it difficult for anybody to sit through the entire movie.

However, what kept me going were conversations in the movie that reminded me of the debates that libertarians have on gun licenses, and their views on liberty and freedom in general. While the movie is said to be inspired by the real life story of a Princeton University student, John Aristotle Phillips, who came to prominence in 1977 as the “A-Bomb Kid” for designing a nuclear weapon in a term paper using publicly available books and articles, it is pretty much relevant even today when nuclear power projects continue to be undertaken under a blanket of tight security.

In particular, the young boy reminded me of Snowden who earned himself the seemingly infamous title of a whistle blower for having exposed some top secret projects of the government that apparently violated the citizen’s right to live a private life. While Snowden might be constantly referred to as a traitor by many, for libertarians and alike, Snowden is no less than a hero who stood up for his right to privacy and freedom. For me, his significant contribution was that he revived the political discourse and debate on liberty and freedom, and the citizen’s right to question the decisions made by the State on behalf of its citizens.

Coming back to the movie, as I had earlier mentioned, certain conversations encouraged me to watch the movie till the end. When the protagonist in the movie, Paul uses “illegal” ways to obtain Plutonium from a medical company to construct an atomic bomb, he is cautioned by someone close who tells him “You try to tough it out with them, they’ll lock you in a room and throw away the room.” After the authorities find out what the Paul has been upto, they declare him a terrorist on all news channels even though it is clear to them that Paul is only a high school student interested in winning an innocent science fair.

Paul then goes into a hiding with his girlfriend Jenny and that’s when they exchange what I feel is the most memorable part of the movie. Jenny who is obviously very scared at the moment tells Paul: “If we get killed we won’t have any future.” Even though Paul might have been as scared, he replies: “Of course we will. You always have a future.”

I think in many ways, Snowden also sacrificed his bright career for a better future of his countrymen and that’s what makes him different from all of us who decide to go with the flow in life. And unlike the boy in the movie, we don’t know if Snowden will have a happy ending or not.

We might be really frustrated with the system around us, unhappy with the taxes we pay and indulge in corruption everyday just because everyone else is apparently more corrupt, but we do little to change things around us. That’s because we are scared of the government. Scared of the very system that was formed in order to protect us and our rights……

I would like to end the post with something that Jenny says to Paul in the movie though I can’t remember the context “Jesus why didn’t they do something. The whole world is collapsing. They just sat around, life as usual, maybe it’ll go away, but it never goes away it only gets worse and nobody thinks about the future. What’s the matter?”

Do watch the movie and let me know what you think. Don’t kill me if you fall asleep in between.